Microfinance in America

Not long after Gretchen Varkonyi separated from her husband, she lost her job at an insurance company. With few resources, the single mom from Providence, Rhode Island, struggled to provide for her children. In June 2010, she turned to a local microcredit organization for a loan to start her own catering business. Varkonyi didn’t have to produce collateral or a minimum credit score to qualify for the loan, but she did have to attend a business training workshop. After building a solid business plan, Varkonyi was able to use the loan for $1,200 to start Dinner Dame gourmet catering company. The venture took off. Varkonyi is now able to provide for her family and hopes to rent a larger kitchen to expand her business.Varkonyi’s company would likely have never existed if it hadn’t been for an enterprising Bangladeshi economist.

Learning from the Least

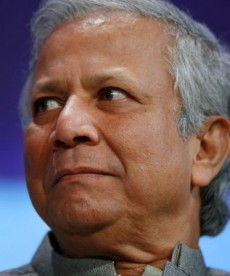

In 1976, while visiting poor households near the village of Jobra, Bangladesh, Muhammad Yunus, Fulbright scholar and professor of economics, realized that a small loan could multiply exponentially in the hands of a skilled worker. Experimentally, Yunus gave a total of $27 USD to 42 Bangladeshi women to purchase bamboo that they made into furniture and sold. Each of the women earned a profit of $0.02 USD. Noting this small—but potentially huge—success, Yunus founded Grameen Bank, the world’s first modern microfinance operation, offering miniature loans to turn poor people into entrepreneurs. Since then, upwards of 12,000 microfinance—also known as microcredit or microenterprise—organizations have sprung up all around the world, ultimately helping 137.5 million poor families pull themselves out of poverty.

This model has grown most rapidly in developing nations, particularly in Africa, Asia, and Latin America.

But these days it’s no longer simply poor women in third world countries who benefit from microloans, but more than 170,000 individuals in America. According to the Aspen Institute and its online database—microTracker.org—which gathers information about microenterprises in United States, an estimated 367 microenterprise organizations exist in the United States (as of August 27, 2012). Forty-five percent of micro-borrowers are minorities, 60 percent come from disadvantaged backgrounds, and 56 percent are women. That number is higher worldwide, with 75 percent female borrowers. In fact, Grameen began lending exclusively to women when they learned that women tend to repay their loans faster than men.

In 2008, Grameen established its first US branch in Queens, New York, under the brand Grameen America (GA). It later expanded to Brooklyn, Upper Manhattan, the Bronx, and recently to Omaha, Nebraska, and Indianapolis, Indiana. As of November 2011, GA had lent a total of $27.5 million to 7,730 borrowers to start small businesses.

As a “micro” lender, Grameen sets a cap at $1,500 for a first-time loan. Borrowers need no bank account, credit history, collateral, or guarantors. That does not mean there are no stipulations. Applicants must 1) have a viable business vision; 2) live below the poverty line; 3) permanently reside in the community where they are requesting the loan; and 4) be a part of a five-member borrowing group. By asking participants to borrow in groups of five, Grameen encourages accountability and creates a safety net for recouping its loans: if one member fails to make a repayment, no one in the group receives a loan until the payment is made.

Additionally, borrowers are required to attend group meetings with a center manager and complete 55 hours of financial literacy training every year. As well, borrowers are required to deposit a minimum of $2 per week into a savings account. All of this encourages healthy saving habits for the future, ultimately eliminating the need for “micro-borrowing.” Interest is charged at 15 percent on a declining debt balance. Loans are typically set at repayment rates of 6- to 12-months.

First Things First

Another variation of the microenterprise model focuses on responding to clients’ daily needs before assisting them in their entrepreneurial aspirations.

In 2008, while pursuing his master’s in environmental studies at Brown University, Andy Posner read Yunus’ autobiography Banker to the Poor, and decided to start his own microenterprise—Capital Good Fund—in Providence, Rhode Island. As the venture took off, Posner began to notice a common thread among potential clients: many were too consumed with tending to immediate needs—like utility or medical bills—to have time to think about starting their own business. According to Posner, of Americans who live below the poverty line, one-fifth of their income is spent on energy bills. So Posner modified his plans in order to help folks get out from under looming financial burdens.

Started with capital from Brown University, Ashoka, local banks, and various individuals and foundations, Capital Good Fund began offering loans to cover the cost of installing programmable thermostats that would save borrowers up to $180 a year in energy costs by making their homes more energy efficient. As well, clients could apply for loan to pay for a laptop, so they would have the ability to search for jobs online and have access to internet banking and financial services. Loans could also help immigrants pay for the fees associated with becoming a citizen. To date, Capital Good has given a total of $180,000 in 167 loans.

Similarly, Grace Period, Inc., in Pittsburgh, Pennsylvania, has focused on ameliorating the stresses of those in financial crisis.

Every year, 12 million Americans apply for loans from payday lenders—or check cashers—who provide high-risk loans at high interest rates to those in financial emergencies, no credit and nowhere else to go. These Americans flock to such outlets, not because they necessarily want to, but because they have been turned away by banks or credit card companies. To mitigate the risks of lending to poor credit, low-income individuals, these lenders charge interest rates often as high as 400 percent APR, in states without strict regulations.

Translated: customers end up in worse financial straits then they started off with. For example, a woman named Sandra borrowed $2,510 from a check casher to pay off her car insurance and mitigate a few other emergencies. When all was said and done, she had paid $10,000 total to cover the loan and all of the interest that accumulated when she couldn’t pay it off in full at the end of the two-week pay period.

Grace Period was created as an alternate to payday lenders. Started by Tony Wiles and Dan Krebs in 2007, as a 501(c)3 affiliated with Allegheny Center Alliance Church, the organization offers loans up to $500 with 13 days free. Established through capital provided by church members, and now partnered with a local credit union, Grace Period not only helps clients get out of trouble but also became financially healthier and smarter. While paying off their loans, clients contribute to a credit account that they can dip into as they have need. This credit account trains clients to save and enables them to eventually open a bank account. To date, more than 3,600 Pittsburgh locals have accessed free loans through Grace Period.

Tempered Success

Despite the growing popularity of microfinance organizations in the West, Aspen estimates that only 2 percent of potential microfinance customers in the US have been served, compared to 17 percent worldwide. There are simply more hoops to jump through. While a few hundred dollars will usually support a business in the developing world, larger loans are typically required to undergird a US startup. Almost five hundred dollars, for instance, would be sufficient to help a Nicaraguan woman outfit her clothing stand, while the average US microloan is around $7,000.

This difference also impacts the perception of such groups in their respective locations. For instance, in the developing world, the model has been referred to as microfinance with an emphasis on very small loans. In the US, microenterprise is preferred, with an emphasis on business building. To this point, 81 percent of US microenterprises offer some form of business training and technical assistance to their clients. Forty percent are committed to helping clients build up their credit by reporting repayment of loans to the credit bureau. Capital Good Fund, for example, requires prospective clients to pay $150 to receive financial coaching. Instead of paying this amount out of pocket, clients pay it off in increments which Capital Good reports to the credit bureau as good credit.

Interest rates tend to be higher in developing countries, so microfinance groups have a better chance of becoming self-sustaining.

“In the US, no microfinance organization is 100 percent self-sufficient,” said Tamra Thetford of the Aspen Institute. “Most people think that’s not attainable. There’s a pretty large difference between interest rates that are charged internationally and nationally.”

The typical interest rate charged by a US microenterprise is 8 percent. Internationally, they can reach 100 percent. As well, the interest rates that a lender can charge carry a significant impact for the sustainability of a microfinance group.

Still, the overall model seems to be accomplishing its goal: to improve the lives of its clients. Based on Aspen’s findings, 18 percent of clients were living in poverty when they applied for a loan. Of that number, 60 percent had moved out of poverty a year after receiving the loan. As of 2008, the number of clients receiving public assistance dropped from 17 percent to 9 percent within a year. Of clients on welfare, only 25 percent were still on welfare two years after receiving a loan; down from 94 percent originally. The average household income of families participating in the program increased from $29,927 to $36,000. And over a five-year period, 88 percent of clients were still operating their own businesses.